Much has been written about the disruption of the mobility market. Recently, I presented a conceivable scenario of how the change could occur and how this might impact car trade and after sales services, for example.

The CEO of a major automotive supplier told me last week that he expects more drastic changes in the next five to ten years than in the last thirty.

To clarify the dimension of this statement: In this time period fell, among other things, the end of the Cold War and the reunification of Germany, the introduction of the Internet and a massive globalization including the opening of China and its rise to the largest automotive market in the world. In the last thirty years, the number of vehicles sold worldwide has doubled, with significantly higher sales prices.

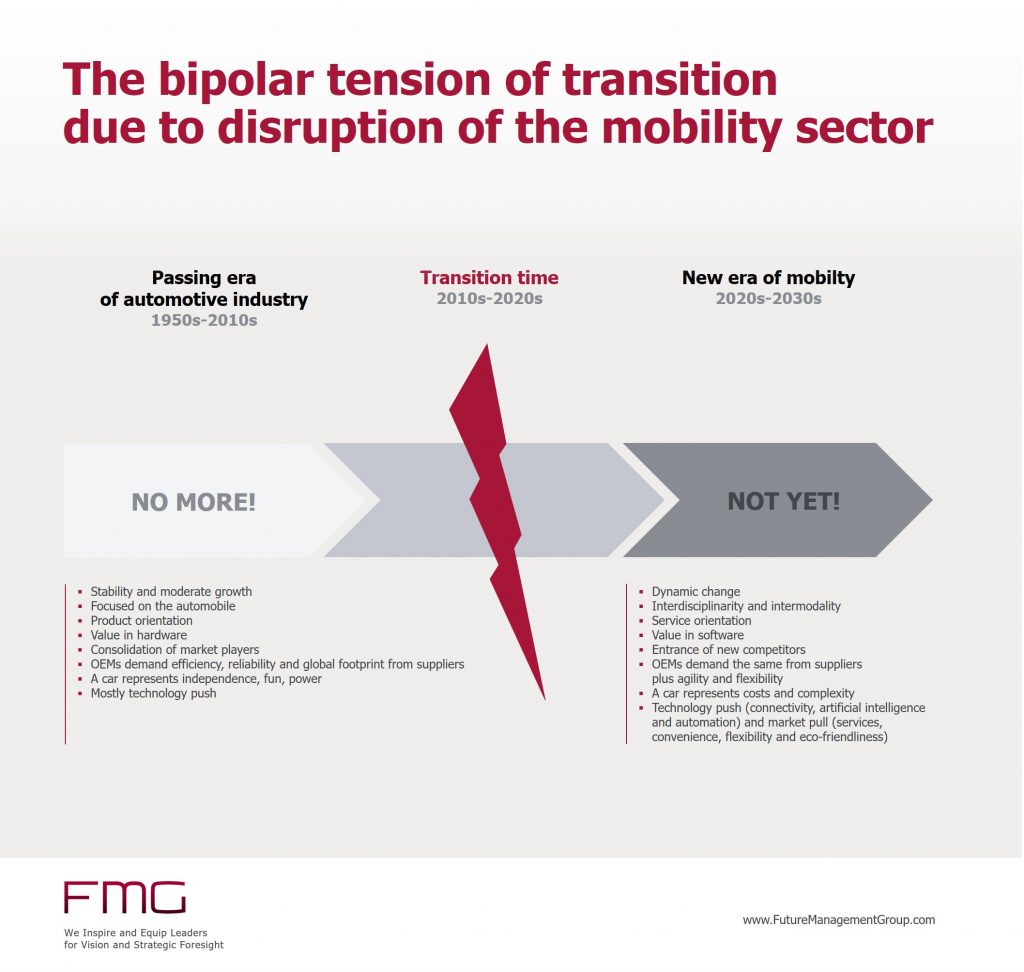

The differences between the old era of the automobile and the new era of mobility are massive. While the old era was characterized by stable markets, continued growth and consolidation, the new era will see exponential growth in some areas coupled with stagnation and shrinkage in other segments. At the same time, the complexity and intensity of competition are increasing. New companies are entering the mobility market as entry barriers change.

Where technology push has often prevailed in recent decades, market pull is gaining ground in many places today because people actively demand other forms of mobility.

Where vehicles used to differentiate with maximum size and performance, today and in the future convenience, intelligent door-to-door solutions and flexibility are required. In the past, OEMs demanded a global footprint, delivery reliability and quality standards from their suppliers. Tomorrow they demand a high level of adaptability, agility and flexibility. Practically all established manufacturers are trying to get a piece of the cake of the attractive segments such as electrification, networking, automation and services.

We are on the way to a new era of mobility. So far so good. But how does the way forward look like? It is clear that automotive suppliers can expect a harsher environment in the coming years. Markets are becoming more volatile, more dynamic and less predictable. The big challenge is to successfully lead an automotive supplier through the ‘transition period’ of the coming years: the established business – mostly dominated by the internal combustion engine – is still profitable and demands attention and resources. In the long run, however, “more of the same” will lead into the abyss. Heavy investment into the new era is already needed today. Conflicting goals arise. What should we do?

1. Develop a clear vision

Every company in the automotive market needs a clear vision of what role it wants to play in the new era. This vision must be a concrete picture of a fascinating and realizable future of the company. It must take the trends and demands of the new era into account. Often in this context, as review of the mission (corporate purpose) is necessary. Questions like: What is the purpose of our company? Who will be our customers in the future? What effects are we responsible for? What is the basis of our unique positioning? What are our sustainable key capabilities? Which market position do we strive for? In which business areas are we active? How big do we want to be in terms of sales and employees? Which know-how qualifies us for the highest level of performance?

2. Maintain competitiveness and cash flows of established businesses

Despite all enthusiasm for the new: the basis for success in the future is the established business. Even if parts of it will play a significantly lesser or no role in the new era. To handle investments in required skills, resources and market access, the earning power of existing business areas is needed. This requires great management attention and clear priorities as well as outstanding operational excellence.

3. Align the business, product and project portfolio to the (new) vision

All activities must be aligned with the vision. This means stopping, refocusing or spinning off non-targeted activities. In most cases, fundamentally new activities also need to be started. Many companies have already massively changed their organizational structure in recent months. Whole business units are merged, rearranged or sold.

4. Define the exit time and strategy

For most automotive suppliers, part of the business depends directly or indirectly on the internal combustion engine. In some cases, up to 100 percent. In the long term, the ICE will only play a marginal role in niches. Therefore, it is imperative to define the right time to exit and how to design it. Predicting the speed of this change is not possible. The forecasts of experts are too extreme, the number of influencing factors is too large. For this reason, the idea is not to think in terms of years, but to observe the market using concrete signals and trigger points that determine when and which measures should be taken. More radical alternatives are to sell segments as soon as possible in the face of great uncertainty or deliberately enforcing a ‘last-man-standing’ strategy, actively pushing the consolidation of the segment to become one of the last survivors in a much smaller market.

5. Invest in new technology fields and business models

Completely new competencies are required to achieve the vision for the new era. Especially the areas of electrics, electronics, networking, sensor technology and data management need attention. But also new materials, the ability to develop new business models or the creation of new market access can be important depending on the desired positioning. To speed up the lengthy organic build-up of the skills they need, many companies rely on M & A activities or collaboration with start-ups through incubator and accelerator programs.

6. Consequence in the implementation and cultural change

he strategy becomes effective only through the consistent implementation in everyday life. Habits and conveniences can complicate or even halt the change. In most established companies, transformation will not succeed unless there is a change in corporate culture. Peter Drucker said: “Culture eats strategy for breakfast” and Jack Welch: “If the rate of change on the outside of the rate of change on the inside, the end is near”. The transformation of an automobile company is a marathon – under time pressure.

This article was first published on blog.futuremanagementgroup.com.